Washington, D.C. 20549

the Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

| | |

Filed by the Registrantý |

Filed by a Party other than the Registranto |

Check the appropriate box: |

o |

|

Preliminary Proxy Statement |

o |

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

ý |

|

Definitive Proxy Statement |

o |

|

Definitive Additional Materials |

o |

|

Soliciting Material under §240.14a-12

|

| | | | |

| Extraction Oil & Gas, Inc. |

(Name of Registrant as Specified In Its Charter) |

|

|

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box): |

ý |

|

No fee required. |

o |

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | (1) | | Title of each class of securities to which transaction applies:

|

| | (2) | | Aggregate number of securities to which transaction applies:

|

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

| | (4) | | Proposed maximum aggregate value of transaction:

|

| | (5) | | Total fee paid:

|

o |

|

Fee paid previously with preliminary materials. |

o |

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

|

|

(1) |

|

Amount Previously Paid:

|

| | (2) | | Form, Schedule or Registration Statement No.:

|

| | (3) | | Filing Party:

|

| | (4) | | Date Filed:

|

Payment of ContentsFiling Fee (Check the appropriate box):

☒ No fee required.

☐ Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

(1) Title of each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

☐ Fee paid previously with preliminary materials.

☐ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

PRELIMINARY COPY – SUBJECT TO COMPLETION – DATED APRIL 14, 2020

MESSAGE FROM THE EXECUTIVE CHAIRMAN

To our Stockholders:

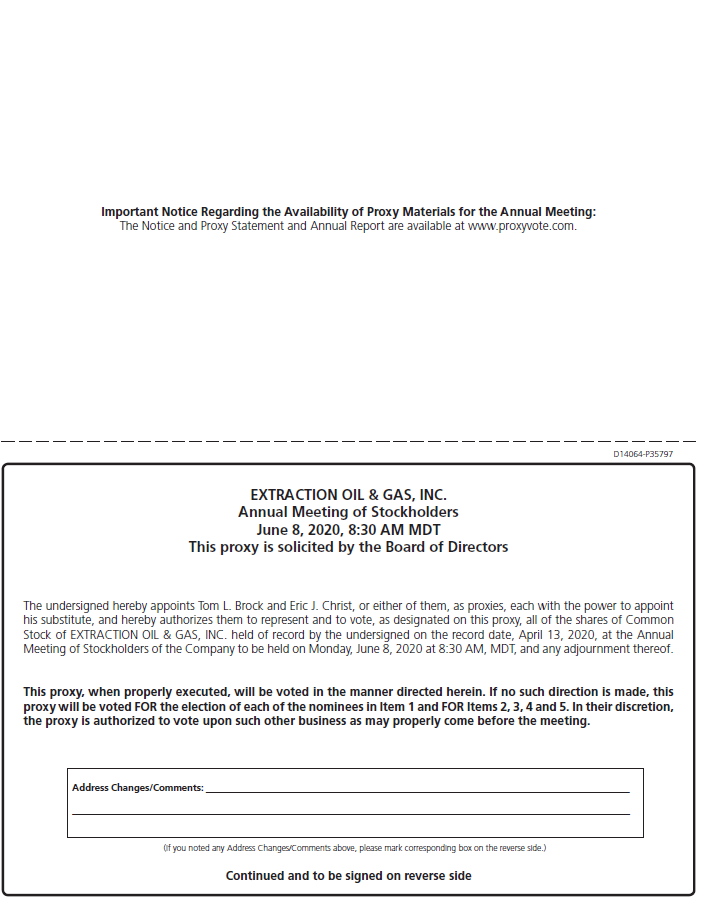

We are pleased to invite you to attend the annual meeting of stockholders of Extraction Oil & Gas, Inc. on Monday, June 8, 2020 at 8:30 a.m., Mountain Time. This year’s annual meeting will be a virtual meeting of stockholders, conducted via live audio webcast. You will be able to attend the annual meeting of stockholders online and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/XOG2020. You will also be able to vote your shares electronically at the annual meeting.

We have embraced the latest technology to provide expanded access, improved communication and cost savings for our stockholders and the Company. Hosting a virtual meeting enables increased stockholder attendance and participation from locations around the world.

Further details about how to attend the meeting online, submit questions before or during the meeting, and information on the business to be conducted at the annual meeting are included in the accompanying Notice of Annual Meeting and proxy statement.

We are providing access to our proxy materials online under the U.S. Securities and Exchange Commission’s “notice and access” rules. As a result, we are mailing to many of our stockholders a notice instead of a paper copy of this proxy statement and our 2019 Annual Report. The notice contains instructions on how to access documents online. The notice also contains instructions on how stockholders can receive a paper copy of our materials, including this proxy statement, our 2019 Annual Report, and a form of proxy card or voting instruction card. Those who do not receive a notice, including stockholders who have previously requested to receive paper copies of proxy materials, will receive a paper copy by mail unless they have previously requested delivery of materials electronically. This distribution process is more resource- and cost-efficient.

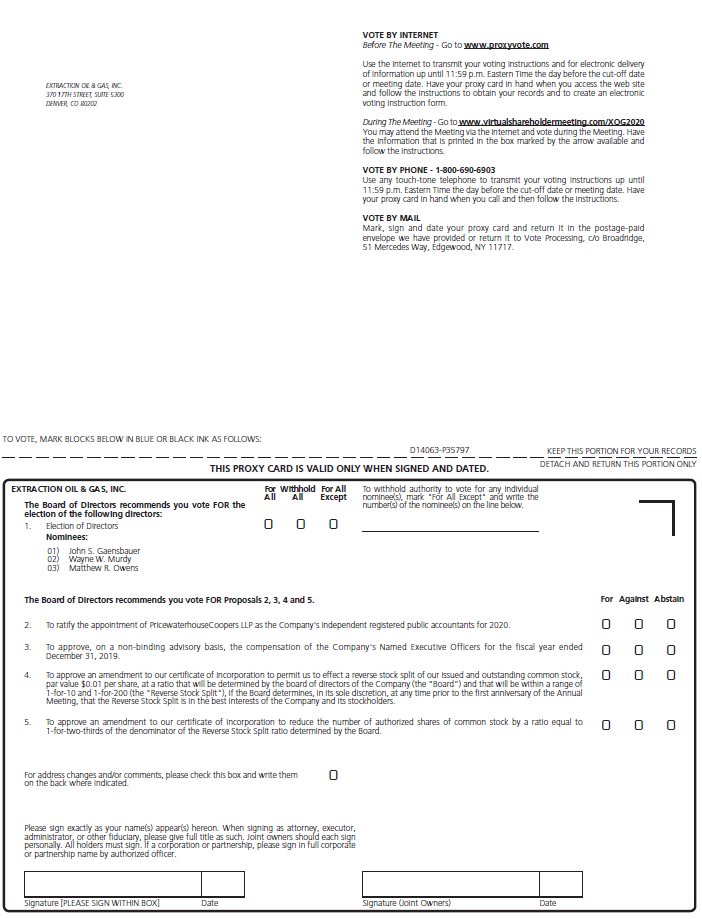

Your vote is important. Regardless of whether you participate in the annual meeting, we hope you vote as soon as possible. You may vote by proxy online or by phone, or, if you received paper copies of the proxy materials by mail, you may also vote by mail by following the instructions on the proxy card or voting instruction card. Voting online or by phone, written proxy or voting instruction card ensures your representation at the annual meeting regardless of whether you attend the virtual meeting.

Thank you for your ongoing support of, and continued interest in, Extraction Oil & Gas, Inc.

Sincerely,

Thomas B. Tyree, Jr.

Executive Chairman

PRELIMINARY COPY – SUBJECT TO COMPLETION – DATED APRIL 14, 2020

EXTRACTION OIL & GAS, INC.

370 17th Street, Suite 5300

Denver, Colorado 80202

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To the stockholders of Extraction Oil & Gas, Inc.:

Notice is hereby given that the 20172020 Annual Meeting of Stockholders of Extraction Oil & Gas, Inc. (the "Company"“Company”) will be held virtually, conducted via live audio webcast on June 8, 2020, at The Houstonian Hotel, 111 N. Post Oak Lane, Houston, Texas, 77024, on May 4, 2017, at 12:00 p.m. Central8:30 a.m. Mountain Time (the "Annual Meeting"“Annual Meeting”). You will be able to attend the Annual Meeting online and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/XOG2020. You will also be able to vote your shares electronically at the Annual Meeting. We believe that a virtual shareholder meeting provides greater access to those who may want to attend and therefore have chosen a virtual meeting over an in-person meeting.

We have elected to deliver our proxy materials to our stockholders over the Internet in accordance with the rules and regulations of the Securities and Exchange Commission (the “SEC”). We believe that this delivery process reduces our environmental impact and lowers the costs of printing and distributing our proxy materials without impacting our stockholders’ timely access to this important information. On __________, 2020, we will send a Notice of Internet Availability of Proxy Materials (the “Notice”) to our stockholders, which contains instructions on how to access our proxy statement for our 2020 Annual Meeting and our 2019 Annual Report on Form 10-K. The Notice also provides instructions on how to vote by telephone or through the Internet and includes instructions on how to receive a paper copy of the proxy materials by mail.

The Annual Meeting is being held for the following purposes:

1. To elect the three Class I directors, set forth in this

Proxy Statementproxy statement, each for a term of three years.

2. To ratify the appointment of PricewaterhouseCoopers LLP as the

Company'sCompany’s independent registered public accountants for the fiscal year ending December 31,

2017.2020.

3. To consider an advisory vote on executive compensation.

4. To approve an amendment to our certificate of incorporation to permit us to effect a reverse stock split of our issued and outstanding common stock, par value $0.01 per share, at a ratio that will be determined by the Board and that will be within a range of 1-for-10 and 1-for-200 (the “Reverse Stock Split”), if the board of directors of the Company (the “Board”) determines, in its sole discretion, at any time prior to the first anniversary of the Annual Meeting, that the Reverse Stock Split is in the best interests of the Company and its stockholders.

5. To approve an amendment to our certificate of incorporation to reduce the number of authorized shares of common stock by a ratio equal to 1-for-two-thirds of the denominator of the Reverse Stock Split ratio determined by the Board.

6. To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

Each outstanding share of the

Company'sCompany’s common stock (NASDAQ: XOG) entitles the holder of record at the close of business on

March 15, 2017,April 13, 2020, to receive notice of and to vote at the Annual Meeting or any adjournment or postponement of the Annual Meeting.

WHETHER OR NOT YOU EXPECT TO VIRTUALLY ATTEND THE MEETING, WE URGE YOU TO VOTE YOUR SHARES BY INTERNET, TELEPHONE, OR BY SIGNING, DATING AND RETURNING THE PROXY CARD IN THE ENCLOSED ENVELOPE. IF YOU CHOOSE TO VIRTUALLY ATTEND THE ANNUAL MEETING, YOU MAY STILL VOTE YOUR SHARES IN PERSON,ELECTRONICALLY AT THE ANNUAL

MEETING, EVEN THOUGH YOU HAVE PREVIOUSLY VOTED OR RETURNED YOUR PROXY BY ANY OF THE METHODS DESCRIBED IN OUR PROXY STATEMENT. IF YOUR SHARES ARE HELD IN A BANK OR BROKERAGE ACCOUNT, PLEASE REFER TO THE MATERIALS PROVIDED BY YOUR BANK OR BROKER FOR VOTING INSTRUCTIONS.

ALL STOCKHOLDERS ARE EXTENDED A CORDIAL INVITATION TO ATTEND THE MEETING.

| | |

| | By Order of the Board of Directors, |

|

|

|

|

|

Mark A. Erickson

Chairman and Chief Executive Officer |

All stockholders are extended a cordial invitation to attend the meeting.

By Order of the Board of Directors,

Eric J. Christ

Vice President, General Counsel & Corporate Secretary

Denver, Colorado

__________, 2020

Important Notice Regarding the Availability of Proxy Materials for the 2020 Annual Meeting of Stockholders to Be Held on May 4, 2017:June 8, 2020, at 8:30 a.m. Mountain Time

This. The proxy statement along with ourand 2019 Annual Report on Form 10-K for the fiscal year ended December 31, 2016 and our 2016 Annual Report to Stockholders, are available free of chargeat www.proxyvote.com. You will be asked to enter the control number located on our website atyour Notice.

TABLE OF CONTENTS

| | | | | |

| ABOUT THE ANNUAL MEETING | 1 |

| Purpose of the Annual Meeting | 1 |

| Proposals to be Voted Upon at the Annual Meeting | 1 |

| Recommendation of the Board | 2 |

| Voting at the Annual Meeting | 2 |

| Quorum Requirement for the Annual Meeting | 3 |

| Required Votes | 3 |

| Solicitation of Proxies | 3 |

| Default Voting | 4 |

| |

| PROPOSAL ONE: ELECTION OF DIRECTORS | 4 |

| Vote Required | 4 |

| Recommendation | 4 |

| |

| DIRECTORS AND EXECUTIVE OFFICERS | 5 |

| |

| MEETINGS AND COMMITTEES OF DIRECTORS | 8 |

| |

| PROPOSAL TWO: RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS | 10 |

| Audit and Other Fees | 10 |

| Vote Required | 10 |

| Recommendation | 11 |

| |

| COMPENSATION COMMITTEE REPORT | 12 |

| |

| COMPENSATION DISCUSSION AND ANALYSIS | 13 |

| Named Executive Officers | 13 |

| Executive Summary | 13 |

| 2019 Company Performance | 13 |

| Changes to Our Executive Compensation Program | 15 |

| CEO Pay at a Glance | 15 |

| Say-on-Pay and Say-on-Frequency | 16 |

| |

| EXECUTIVE COMPENSATION PHILOSOPHY AND OBJECTIVES | 16 |

| |

| HOW WE MAKE COMPENSATION DECISIONS | 17 |

| |

| ELEMENTS OF COMPENSATION | 19 |

| Base Salary | 19 |

| Annual Incentive Bonus—2019 Short-Term Cash Incentive Program (STIP) | 19 |

| 2019 Awards under the LTIP | 22 |

| Other Compensation Elements | 24 |

| |

| EMPLOYMENT AGREEMENTS | 24 |

| |

| POST-EMPLOYMENT ARRANGEMENTS | 24 |

| |

| TAX AND ACCOUNTING CONSIDERATIONS | 25 |

| |

| | | | |

ABOUT THE ANNUAL MEETING

| | | 1 | |

PROPOSAL ONE:

ELECTION OF DIRECTORS

RISK ASSESSMENT AND MITIGATION | | | 4 | 25 |

DIRECTORS AND EXECUTIVE OFFICERS

2019 Summary Compensation Table | | | 5 | 27 |

MEETINGS AND COMMITTEES OF DIRECTORS

Realized Compensation | | | 8 | 28 |

EXECUTIVE COMPENSATION

Grants of Plan-Based Awards | | | 11 | 28 |

Narrative Disclosure to Summary Compensation Table and Grants of Plan-Based Awards Table | 29 |

| Outstanding Equity Awards at Fiscal Year-End | 30 |

| Options Exercises and Stock Vested | 32 |

| Potential Payments upon Termination or Change in Control | 33 |

| Table Illustrating Potential Payments upon Termination or Change in Control | 35 |

| Director Compensation | 37 |

| Narrative Disclosure to Director Compensation Table | 37 |

| Director Stock Ownership Guidelines | 38 |

| |

| COMPENSATION COMMITTEE INTERLOCKS AND INSIDER PARTICIPATION | | | 23 | 40 |

CORPORATE GOVERNANCE

| | | 24 | |

CORPORATE GOVERNANCE | 40 |

| Corporate Governance Guidelines | 40 |

| Board Leadership | 41 |

| Classified Board Structure | 41 |

| Communications with the Board of Directors | 41 |

| Director Independence | 41 |

| Financial Literacy of Audit Committee and Designation of Financial Experts | 42 |

| Oversight of Risk Management | 42 |

| Attendance at Annual Meetings | 42 |

| |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | | | 27 | 43 |

| |

| SECTION 16(A) BENEFICIAL OWNERSHIP REPORTING COMPLIANCE | | | 30 | 46 |

| |

| TRANSACTIONS WITH RELATED PERSONS | | | 31 | 47 |

PROPOSAL TWO:

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

Policies and Procedures for Review of Related Party Transactions | | | 35 | 47 |

Historical Transactions with Affiliates | 47 |

| |

| PROPOSAL THREE: ADVISORY (NON-BINDING) VOTE ON EXECUTIVE COMPENSATION | 49 |

| Vote Required | 49 |

| Recommendation | 50 |

| |

| PROPOSAL FOUR: TO APPROVE THE REVERSE STOCK SPLIT | 51 |

| Background and Reasons for the Reverse Stock Split; Potential Consequences of the Reverse Stock Split | 51 |

| Certain Risks Associated with the Reverse Stock Split | 52 |

| Determination of the Specific Reverse Stock Split Ratio | 53 |

| Procedure for Implementing the Reverse Stock Split | 53 |

| Amendment Effective Time | 53 |

| Reservation of Right to Abandon Reverse Stock Split | 53 |

| Effect of the Reverse Stock Split on Holders of Outstanding Common Stock | 54 |

| Effect of the Reverse Stock Split on Holders of our Series A Preferred Stock | 54 |

| Authorized Shares of Common Stock | 55 |

| Exchange of Stock Certificates | 55 |

| | | | | |

| Fractional Shares | 56 |

| No Appraisal Rights | 56 |

| Effect of the Reverse Stock Split on Equity Compensation Plans and Awards | 56 |

| Regulatory Effects | 57 |

| Interests of Certain Persons in the Proposal | 57 |

| Accounting Matters | 57 |

| Material U.S. Federal Income Tax Consequences of the Reverse Stock Split | 57 |

| Vote Required | 59 |

| Recommendation | 59 |

| |

| PROPOSAL FIVE: TO APPROVE THE AUTHORIZED SHARE REDUCTION | 60 |

| General | 60 |

| Reasons for the Authorized Share Reduction | 60 |

| Effects of the Authorized Share Reduction | 60 |

| Vote Required | 61 |

| Recommendation | 61 |

| |

| AUDIT COMMITTEE REPORT | | | 36 | 62 |

| |

| STOCKHOLDER PROPOSALS; IDENTIFICATION OF DIRECTOR CANDIDATES | | | 37 | 63 |

| |

| SOLICITATION OF PROXIES | | | 38 | 64 |

STOCKHOLDER LIST

| | | 38 | |

STOCKHOLDER LIST | 64 |

| |

| AVAILABILITY OF CERTAIN DOCUMENTS | | | 38 | 64 |

OTHER MATTERS

| | | 39 | |

DIRECTIONS TOOTHER MATTERS

| 65 |

| |

| LOCATION OF ANNUAL MEETING | 65 |

| |

| APPENDIX A | 39 | 66 |

i

EXTRACTION OIL & GAS, INC.

370 17th Street, Suite 5300

Denver, Colorado 80202

PROXY STATEMENT

2017

2020 ANNUAL MEETING OF STOCKHOLDERS

The Board of Directors (the "Board“Board of Directors"Directors” or the "Board"“Board”) of Extraction Oil & Gas, Inc. (the "Company"“Company”) requests your proxy for the 20172020 Annual Meeting of Stockholders that will be held on May 4, 2017,June 8, 2020, which will be a virtual meeting of stockholders, conducted via live audio webcast, at The Houstonian Hotel, 111 N. Post Oak Lane, Houston, Texas, 77024, at 12:00 p.m. Central8:30 a.m. Mountain Time (the "Annual Meeting'“Annual Meeting”). You will be able to attend the annual meeting of stockholders online and submit questions during the meeting by visiting www.virtualshareholdermeeting.com/XOG2020. You will also be able to vote your shares electronically at the annual meeting.

By granting the proxy, you authorize the persons named on the proxy to represent you and vote your shares at the Annual Meeting. Those persons will also be authorized to vote your shares to adjourn the Annual Meeting from time to time and to vote your shares at any adjournments or postponements of the Annual Meeting. The Board has made this proxy statement (the "Proxy Statement"“Proxy Statement”), proxy card, the accompanying Notice of Annual Meeting of Stockholders and the Company's 2016Company’s 2019 Annual Report to Stockholderson Form 10-K available on the Internet at www.proxyvote.com. The approximate date on which these proxy materials and the Company's 2016Company’s 2019 Annual Report to Stockholders are first being mailedmade available to stockholders is April 6, 2017., 2020. ABOUT THE ANNUAL MEETING

Purpose of the Annual Meeting

The purpose of the Annual Meeting is for our stockholders to consider and act upon the proposals described in this Proxy Statement and any other matters that properly come before the Annual Meeting or any adjournment or postponement thereof.

Proposals to be Voted Upon at the Annual Meeting

At the Annual Meeting, our stockholders will be asked to consider and vote upon the following

twofour proposals:

•Proposal ONE: To elect the three Class I directors to the Board set forth in this Proxy Statement, each of whom will hold office until the 20202023 Annual Meeting of Stockholders and until his successor is elected and qualified or until his earlier death, resignation or removal.

•Proposal TWO: To ratify the appointment of PricewaterhouseCoopers LLP ("PwC"(“PwC”) as the Company'sCompany’s independent registered public accounting firm for the fiscal year ending December 31, 2017.2020.

•Proposal THREE: To approve, on an advisory basis, the compensation of our Named Executive Officers (as defined below).

•Proposal FOUR: To approve an amendment to our certificate of incorporation to permit us to effect a reverse stock split of our issued and outstanding common stock, par value $0.01 per share (the “Common Stock”), at a ratio that will be determined by the Board and that will be within a range of 1-for-10 and 1-for-200 (the “Reverse Stock Split”), if the Board determines, in its sole discretion, at any time prior to the first anniversary of the Annual Meeting, that the Reverse Stock Split is in the best interests of the Company and its stockholders.

•Proposal FIVE: To approve an amendment to our certificate of incorporation to reduce the number of authorized shares of Common Stock by a ratio equal to 1-for-two-thirds of the denominator of the Reverse Stock Split ratio determined by the Board (the “Authorized Share Reduction”).

In addition, any other matters that properly come before the Annual Meeting or any adjournment or postponement thereof will be considered. Management is presently aware of no other business to come before the Annual Meeting.

Recommendation of the Board

The Board unanimously recommends that you vote FOR the election of each of the nominees to the Board (Proposal ONE) and, FOR the ratification of the appointment of PwCPricewaterhouseCoopers LLP as our independent registered public accounting firmthe auditors of the Company for the fiscal year ending December 31, 20172020 (Proposal TWO), FOR the approval, on an advisory basis, of the executive compensation of the Named Executive Officers (Proposal THREE), FOR the approval of the Reverse Stock

Split (Proposal FOUR) and FOR the Authorized Share Reduction (Proposal FIVE).

Voting at the Annual Meeting

The

Company's common stock, par value $0.01 per share (the "Common Stock"),Common Stock, is the only class of securities that entitles holders to vote generally at meetings of the

Company'sCompany’s stockholders. Each stockholder of record at the close of business on

March 15, 2017April 13, 2020 (the

"Record Date"“Record Date”), is entitled to

Table of Contents

vote at the Annual Meeting. Holders of the Common Stock will vote together on all matters presented at the Annual Meeting. Each share of Common Stock outstanding on the Record Date entitles the holder to one vote at the Annual Meeting.

If on the Record Date you hold shares of our Common Stock that are represented by stock certificates or registered directly in your name with our transfer agent, American Stock Transfer & Trust Company

(our “Transfer Agent”), you are considered the stockholder of record with respect to those shares. Broadridge Financial Solutions

("Broadridge"(“Broadridge”) is sending these proxy materials directly to you on our behalf. As a stockholder of record, you may vote

in person at the Annual Meeting,

which will be held virtually, or by proxy. Whether or not you plan to attend the

virtual Annual Meeting,

in person, you may vote by Internet by following the instructions on the proxy card you received. You may also vote by signing and submitting your proxy card or by submitting your vote by telephone by

callcalling the number provided on the proxy card you received. Whether or not you plan to attend the

virtual Annual Meeting, we urge you to vote by way of the Internet, by telephone or by filling out and returning the proxy card in the enclosed envelope. If you submit a proxy but do not give voting instructions as to how your shares should be voted on a particular proposal at the Annual Meeting, your shares will be voted in accordance with the recommendations of our Board stated in this Proxy Statement. Any proxy given pursuant to this solicitation may be revoked by the person giving it at any time before its use by (a) delivering a written notice of revocation addressed to Extraction Oil & Gas, Inc., Attn: General Counsel, 370 17th Street, Suite 5300, Denver, Colorado 80202, (b) a duly executed proxy bearing a later date, (c) voting again by Internet or by telephone or (d) attending the

virtual Annual Meeting and voting

in person.during the meeting. Your last vote or proxy will be the vote or proxy that is counted. Attendance at the

virtual Annual Meeting will not cause your previously granted proxy to be revoked unless you vote or specifically so request.

If on the Record Date you hold shares of our Common Stock in an account with a brokerage firm, bank or other nominee, then you are a beneficial owner of the shares and hold such shares in

"street“street name,

"” and these proxy materials will be

forwardedprovided to you by that organization. As a beneficial owner, you have the right to direct your broker, bank or other nominee on how to vote the shares held in their account, and the nominee has enclosed or provided voting instructions for you to use in directing it how to vote your shares. The nominee that holds your shares, however, is considered the stockholder of record for purposes of voting at the Annual Meeting. Because you are not the stockholder of record, you may not vote your shares

in person at the

virtual Annual Meeting

unlessand you

bringwould need to instruct your brokerage or bank as to your vote prior to the Annual

Meeting a letter from your broker, bank or other nominee confirming your beneficial ownership of the shares.Meeting. Whether or not you plan to attend the

virtual Annual Meeting, we urge you to vote by following the voting instructions provided to you to ensure that your vote is counted.

If you are a beneficial owner and do not vote, and your broker, bank or other nominee does not have discretionary power to vote your shares, your shares may constitute

"broker“broker non-votes.

"” Shares that constitute broker non-votes will be counted for the purpose of establishing a quorum at the Annual Meeting, but will only be taken into account in determining the outcome of a proposal for which brokers have discretionary authority, as discussed below. Voting results will be tabulated and certified by the inspector of elections appointed for the Annual Meeting. If you receive more than one copy

or notice of proxy materials, it is because your shares are registered in more than one name or are registered in different accounts. Please follow the instructions on the respective proxy card or voting instructions received to ensure that all of your shares are voted.

A complete list of the stockholders of record entitled to vote at the Annual Meeting will be availableopen to the examination of any stockholder, for inspectionpurposes germane to the Annual Meeting, during ordinary business hours for a period of ten days before the Annual Meeting at our corporate offices located at 370 17th Street, Suite 5300, Denver, Colorado 80202. The list of stockholders will also be available for inspection atstockholders during the Annual Meeting.Meeting through the link www.virtualshareholdermeeting.com/XOG2020.

Table of Contents

Quorum Requirement for the Annual Meeting

The presence at the Annual Meeting, whether in person or by valid proxy, of the persons holding a majority of shares of Common Stock outstanding on the Record Date will constitute a quorum, permitting us to conduct our business at the Annual Meeting. On the Record Date, there were 171,834,605 shares of Common Stock outstanding, held by 224 stockholders of record. Abstentions (i.e.(i.e., if you or your broker mark "ABSTAIN"“ABSTAIN” on a proxy) and broker non-votes will be considered to be shares present at the meeting for purposes of a quorum. Broker non-votes occur when shares held by a broker for a beneficial owner are not voted with respect to a particular proposal and generally occur because the broker (a) does not receive voting instructions from the beneficial owner and (b) lacks discretionary authority to vote the shares. Brokers and other nominees have discretionary authority to vote on ratification of our independent public accounting firm for clients who have not provided voting instructions. However, without voting instructions from their clients, they cannot vote on "non-routine"“non-routine” proposals, including the election of directors.

Required Votes

Election of Directors. Each director will be elected by the affirmative vote of the plurality of the votes cast by stockholders entitled to vote on the election of directors at the Annual Meeting. Abstentions and broker non-votes are not taken into account in determining the outcome of the election of directors.

Ratification of our Independent Public Accounting Firm. Approval of the proposal to ratify the Audit Committee'sCommittee’s appointment of PwC as our independent registered public accounting firm for the fiscal year ending December 31, 2017,2020, requires the affirmative vote of the holders of at least a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote. Brokers have the discretion to vote on this proposal if they do not receive voting instructions from the beneficial owner, and abstentions will have the effect of a vote against this proposal.

Advisory (Non-Binding) Vote on Executive Compensation. Approval, on an advisory basis, of the compensation of our Named Executive Officers requires the affirmative vote of the holders of a majority of the shares of Common Stock present in person or represented by proxy at the Annual Meeting and entitled to vote. Brokers have the discretion to vote on this proposal if they do not receive voting instructions from the beneficial owner, and abstentions will have the effect of a vote against this proposal.

Reverse Stock Split. Approval of this proposal requires the affirmative vote, either in person or by proxy, of

the holders of at least a majority of the issued and outstanding shares of Common Stock. Abstentions, failing to vote, and “broker non-votes” will have the same effect as voting “AGAINST” the adoption of this proposal because the required vote is based on the number of shares outstanding rather than the number of votes cast.

Authorized Share Reduction. Approval of this proposal requires the affirmative vote, either in person or by

proxy, of the holders of at least a majority of the issued and outstanding shares of Common Stock. Abstentions, failing to vote, and “broker non-votes” will have the same effect as voting “AGAINST” the adoption of this proposal because the required vote is based on the number of shares outstanding rather than the number of votes cast.

Solicitation of Proxies

We will bear the cost of solicitation of proxies. This includes the charges and expenses of brokerage firms and others for forwarding solicitation material to beneficial owners of our outstanding Common Stock. We may solicit proxies by mail, personal interview, telephone or via the Internet through our officers, directors and other management employees, who will receive no additional compensation for their services.

Default Voting

A proxy that is properly completed and submitted will be voted at the Annual Meeting in accordance with the instructions on the proxy. If you properly complete and submit a proxy but do not indicate any voting instructions, your shares will be voted FOR each of the director nominees listed in Proposal ONE,

FOR Proposal TWO and FOR Proposal

TWO.THREE. Because brokers do not have discretionary authority to vote on Proposal FOUR or Proposal FIVE, broker non-votes will have the same effect as voting “AGAINST” Proposal FOUR and “AGAINST” Proposal FIVE.

If any other business properly comes before the stockholders for a vote at the meeting, your shares will be voted in accordance with the discretion of the holders of the proxy. The Board of Directors knows of no matters, other than those previously stated, to be presented for consideration at the Annual Meeting.

Extraction Oil & Gas Holdings, LLC, a Delaware limited liability company and our accounting predecessor, was formed on May 29, 2014 by PRE Resources, LLC ("PRL") as a holding company with no independent operations. Extraction Oil & Gas, LLC, was a wholly owned subsidiary of Extraction Oil & Gas Holdings, LLC. In connection with the consummation of our initial public offering (the

Table of Contents

"IPO"), Extraction Oil & Gas Holdings, LLC was merged with and into Extraction Oil & Gas, LLC and Extraction Oil & Gas, LLC converted from a Delaware limited liability company into a Delaware corporation, Extraction Oil & Gas, Inc. On October 11, 2016, a registration statement filed on Form S-1 with the SEC relating to shares of our Common Stock was declared effective. The IPO closed on October 17, 2016.

In this Proxy Statement, the terms

"the“the Company,

" "we," "us," "our"” “we,” “us,” “our” and similar terms

when used in the present tense, prospectively or for historical periods since October 17, 2016, refer to Extraction Oil & Gas, Inc. and its subsidiaries,

and for historical periods prior to October 17, 2016, refer to Extraction Oil & Gas Holdings, LLC, and its subsidiaries, unless the context indicates otherwise.

PROPOSAL ONE:

ELECTION OF DIRECTORS

At the recommendation of the Nominating and Governance Committee, the Board of Directors has nominated the following individuals for election as Class I directors of the Company, to serve for three-year terms beginning at the Annual Meeting and expiring at the

20202023 Annual Meeting of the Stockholders, and until either they are re-elected or their successors are elected and qualified:

John S. Gaensbauer

Wayne W. Murdy

Matthew R. Owens

Wayne W. Murdy

John S.

Messrs. Gaensbauer,

Mr. Owens, Mr. Murdy and Mr. GaensbauerOwens are currently serving as directors of the Company. If Mr. Owens, Mr.Messrs. Gaensbauer, Murdy and Mr. GaensbauerOwens are elected to the Board of Directors, the size of the Board will remain at eight members. Biographical information for each nominee is contained in the "Directors“Directors and Executive Officers"Officers” section below.

The Board of Directors has no reason to believe that its nominees will be unable or unwilling to serve if elected. If a nominee becomes unable or unwilling to accept nomination or election, either the number of the

Company'sCompany’s directors will be reduced or the persons acting under the proxy will vote for the election of a substitute nominee that the Board of Directors recommends.

Vote Required

The election of directors in this Proposal ONE requires the affirmative vote of a plurality of the votes cast by stockholders entitled to vote on the election of directors. Neither abstentions nor broker non-votes will have any effect on the outcome of voting on director elections.

Recommendation

The Board of Directors unanimously recommends that stockholders vote FOR the election of each of the nominees.nominees.

Table of Contents

DIRECTORS AND EXECUTIVE OFFICERS

After the Annual Meeting, assuming the stockholders elect the nominees of the Board of Directors as set forth in

"Proposal“Proposal ONE: Election of

Directors"Directors” above, the Board of Directors of the Company will be, and the executive officers of the Company are:

| | | | | |

Name

| | Age | | Position | | | | | | | | | |

|---|

Mark A. Erickson(3)(4)

Name | | Age | 57 | Position |

| Thomas B. Tyree, Jr. | | 59 | | Executive Chairman |

| Matthew R. Owens | | 33 | | President, Chief Executive Officer and Chairman |

Matthew R. Owens(4)

| | | 30 | | President and Director |

Russell T. Kelley, Jr.

| | | 41 | | Chief Financial Officer |

Tom L. Brock | | 47 | 44 | | Vice President, Chief Accounting Officer |

Eric J. Christ | | 40 | 37 | | Vice President, General Counsel and Corporate Secretary |

Marianella Foschi | | 32 | | Vice President of Finance |

| Marvin M. Chronister | | 69 | | Independent Director |

| John S. Gaensbauer | | 49 | 46 | | Independent Director |

Peter A. Leidel(1)(2)(3)(4) Leidel | | 63 | 60 | | Independent Director |

Marvin M. Chronister(1)(2)(3)

Wayne W. Murdy | | 75 | 66 | | Lead Independent Director |

Patrick D. O'Brien(2)(3)(4) O’Brien | | 71 | 68 | | Independent Director |

Wayne W. Murdy(1)(3)

Audrey Robertson | | 39 | 72 | | Director |

Donald L. Evans(1)(4)

| | | 70 | | Independent Director |

(1)Member of the Audit Committee.

(2)Member of the Compensation Committee.

(3)Member of the Nominating and Governance Committee.

(4)Member of the Executive Committee.

The Company'sCompany’s Board of Directors currently consists of eight members, and if the stockholders elect Mr. Owens, Mr.Messrs. Gaensbauer, Murdy and Mr. GaensbauerOwens to the Board, the Board will continue to consist of eight members. The Company'sCompany’s directors are divided into three classes serving staggered three-year terms. Each year, the directors of one class stand for re-election as their terms of office expire. Messrs. Owens, Murdy and Gaensbauer are designated as Class I directors, and, assuming the stockholders elect them to the Board as set forth in "Proposal“Proposal ONE: Election of Directors"Directors” above, their terms of office will expire in 2020.2023. Messrs. O'BrienO’Brien and Chronister and Ms. Robertson are designated as Class II directors, and their terms of office will expire in 2018.2021. Messrs. Erickson,Tyree and Leidel and Evans are designated as Class III directors, and their terms of office will expire in 2019.

2022.

Set forth below is biographical information about each of the

Company'sCompany’s executive officers, directors and nominees for director.

Mark A. Erickson—Chief

Thomas B. Tyree, Jr.—Executive Officer and Chairman.Mr. Erickson is our Chairman, CEO and co-founder. From 2010 to 2014, heTyree has served as our Executive Chairman since March 2020. Mr. Tyree also currently serves as a director of Antero Resources Corporation and CEO of Denver-based PRE Resources, LLC ("PRL"), a privately held oil and gas exploration and development company, where he remains as non-executive Chairman of the Board. From 2001 to 2010, Mr. Erickson served as CEO, President and DirectorBoard of publicly traded GascoNorthwoods Energy Inc. ("Gasco Energy"),LLC, a Uinta Basin-focused oil & gas company which he co-founded. Mr. Erickson served as President of Pannonian Energy Inc. from mid-1999 until it merged with Gasco Energy in February 2001. In late 1997, Mr. Erickson co-founded Pennaco Energy, Inc. ("Pennaco"), a publicly tradedprivate oil and gas company with propertiesassets in Wyoming'sWyoming’s Powder River Basin. HeMr. Tyree was previously Northwoods’ founder, CEO, and Executive Chairman, from January 2018 until April 2019. Mr. Tyree also served as a Director of Bonanza Creek Energy from April 2017 through March 2020. Before that, he served as President, Chief Financial Officer and member of the Board of Managers of Vantage Energy, LLC from 2006 to 2016 and as Chief Financial Officer of Bill Barrett Corporation from 2003 through 2006. Prior to Bill Barrett, from 1989 to 2003, Mr. Tyree was an officerinvestment banker at Goldman, Sachs & Co., ultimately serving as Managing Director in the Energy Group. Mr. Tyree earned a Bachelor of Arts degree from Colgate University, where he currently serves as a member of its Board of Trustees. He also holds a Master of Business Administration degree from the Wharton School at the University of Pennsylvania. Mr. Tyree's extensive experience as chairman and leadership roles with oil and gas companies and an investment banker, together with his knowledge of the energy industry, has led the Board to conclude that he has the expertise necessary to serve as a director of Pennaco from its inception until mid-1999. Mr. Erickson began his career at North American Resources, which was the exploration and production subsidiary of Montana Power Company. A Helena, Montana native, Mr. Erickson has over 30 years of experience in business development, finance, strategic planning, marketing, project management and petroleum engineering. He holds an MS in mineral economics from the Colorado School of Mines and

Table of Contentsa BS in petroleum engineering from the Montana College of Mineral Science and Technology. We believe that Mr. Erickson's experience founding and leading our growth as ourMatthew R. Owens—President, Chief Executive Officer and his extensive experience leading various oil and gas companies qualify him to serve on our board of directors.

Matthew R. Owens—President and Director. Mr. Owens is a founder of the Company and has been its President and Chief Executive Officer since February 2020. From our co-founderformation until April 2019, he served as our President and President.from April 2019 to March 2020 he served as our Acting Chief Executive Officer. Mr. Owens has also served as a director of Triple Crown Resources, LLC, a private producer in the Midland Basin, since April 2017. From 2008 to 2010, he served as Operations Engineer for Gasco Energy, working deep, high-pressured gas in the Uinta Basin. While at Gasco Energy, he drilled and completed over 50 wells in the Mancos, Blackhawk and Mesaverde formations. From 2010-2012, Mr. Owens worked at PDC Energy, Inc., an oil and gas exploration and development company with a primary focus on the Wattenberg Field, as an Operations

Engineer, leading the horizontal completion and production activities in the Wattenberg Field. He completed over 45 horizontal Codell and Niobrara wells and was responsible for optimizing production for the program. Mr. Owens has been our President since our formation in 2012, which, at the time, was a wholly owned subsidiary of PRL. Mr. Owens holds a BS degree in petroleum engineering from the Colorado School of Mines. We believe that Mr. Owens'Owens’ experience founding and leading our growth as our President and his background in completion and production activities qualify him to serve on our board of directors.

Russell T. Kelley, Jr.—Chief Financial Officer. Mr. Kelley has served as our Chief Financial Officer since July 2014. Prior to joining us, he ran the Oil & Gas practice of Moelis & Company, a global investment bank, from 2011 to 2014, where he was a partner and managing director covering upstream and integrated oil & gas companies. From 2005 to 2011, he worked at Goldman, Sachs & Co., a global investment bank, where he was a Senior Vice President. In such roles, Mr. Kelley has executed over $70 billion of M&A/advisory assignments and has led capital market transactions raising over $15 billion for clients. He has been in the energy and financial sector since 1998, with experience in commodities trading, corporate development and investment banking. He holds a MBA from The Wharton School at the University of Pennsylvania where he graduated as a Palmer Scholar and a BA from Vanderbilt University.Tom L. Brock—Vice President, Chief Accounting Officer. Mr. Brock has served as our Vice President, Chief Accounting Officer since October 2016. Prior to that time, Mr. Brock served as our Senior Director of Accounting since August 2016. Prior to joining us, Mr. Brock served as Vice President, Chief Accounting Officer and Corporate Controller of the American Midstream GP, LLC and American Midstream Partners, LP from November 2013 until his resignation in August 2016. Mr. Brock had previously served as Vice President and Corporate Controller of American Midstream GP, LLC and American Midstream Partners LP from July 2012 until November 2013. Prior to that, Mr. Brock held the position of Director of Trading and Finance with BG Group in Houston, Texas, where he controlled accounting and other functions for its marketing and trading companies beginning in July 2010. Mr. Brock began his career with KPMG LLP, where he spent 13 years holding various positions serving clients in the energy industry. Mr. Brock holds a Bachelor of Accountancy from New Mexico State University and is a CPA licensed in the State of Texas.

Eric J. Christ—Vice President, General Counsel and Corporate Secretary. Mr. Christ has served as our Vice President, General Counsel and Corporate Secretary since November 2016. Prior to joining us, Mr. Christ served as Vice President, Corporate Secretary and General Counsel at VAALCO Energy Inc. from January 2015 to November 2016. Prior to joining VAALCO, Mr. Christ served as Vice President, General Counsel and Corporate Secretary of Midstates Petroleum Company, Inc. from November 2013 to January 2015 and as its Assistant Corporate Counsel from September 2012 to November 2013. Mr. Christ began his legal career at Porter Hedges, LLP in 2005 and continued on to practice corporate and securities law at Vinson & Elkins LLP from 2006 until 2010, where he represented a variety of energy companies. Mr. Christ holds a Bachelor of Arts, with honors, from Amherst College and a J.D., with honors, from the University of Texas School of Law.

Table of Contents John S. Gaensbauer—Director.Marianella Foschi—Vice President, Finance Mr. Gaensbauer serves as a member of our board of directors, where he. Ms. Foschi has served as our Vice President, Finance since our inception. Mr. Gaensbauer is currently a ManagingSeptember 2019. She previously served as Director in the Natural Resource Groupof Finance at Headwaters MB, a Denver-based investment banking firm ("Headwaters").Extraction from May 2015 until September 2019. Prior to joining HeadwatersExtraction, from 2012 to 2015 Ms. Foschi was an Associate at The Blackstone Group in May 2016, Mr. GaensbauerHouston, focused on mezzanine debt and equity investments across the energy sector. While at The Blackstone Group, Ms. Foschi was a partner at Sierra Partners LLC, a Denver-based,responsible for investing $1.5 billion of private advisory group providing strategic advisory services to clientscapital in the global resource industry ("Sierra Partners"), a role he held since 2007. Priorenergy sector. From 2010 to Sierra Partners, Mr. Gaensbauer served as Group Executive, Investor Relations2012, Ms. Foschi was an energy investment banker at Credit Suisse where she developed her expertise in debt, equity and advisory assignments for Newmont Mining Corporation ("Newmont"). Prior to that, Mr. Gaensbauer served as in-house counsel to Newmont, managing the legal affairsexploration and transactions for Newmont's West African, Central Asianproduction, midstream and European operations, as well as counsel to Newmont's Treasury Group and Newmont Capital, Newmont's in-house merchant banking group. Prior to joining Newmont, Mr. Gaensbauer practiced corporate and transactional law at Ballard Spahr LLP. Mr. Gaensbauer is currently a director of PRE Resources, LLC, a position he has held since February 2011. Mr. Gaensbaueroilfield services companies. Ms. Foschi holds a BA degree from Cornell UniversityBachelor in Business Administration (Finance), with highest honors, and Mastersa Bachelor of Finance and JD degreesArts in Economics, both from the University of Denver. Mr. Gaensbauer has an extensive background in international mining and natural resource transactions and finance which we believe qualify him for service on our board of directors.Texas.

Peter A. Leidel—Director.

Mr. Leidel has served as a member of our board of directors since our inception and as a director of PRL since June 2012. Mr. Leidel is a member of Yorktown Partners LLC ("Yorktown"), a position he has held since he co-founded it in September 1990. Previously, he was a partner of Dillon, Read & Co. Inc.'s venture capital group, an investment bank, held corporate treasury positions at Mobil Corporation, an oil and gas company, and worked for KPMG LLP, an accounting firm, and for the U.S. Patent and Trademark Office. Mr. Leidel is a director of Mid-Con Energy Partners L.P. and Carbon Natural Gas Company and is also a director of certain non-public companies in the energy industry in which Yorktown's funds hold equity interests. He is also a director of the University of Wisconsin Foundation. He is a graduate of the University of Wisconsin, with a BBA degree in accounting and of the Wharton School at the University of Pennsylvania, with a MBA. We believe that Mr. Leidel's strong accounting background and previous experience serving as director of various public companies engaged in the oil and natural gas industry qualify him for service on our board of directors.Marvin M. Chronister—Independent Director. Mr. Chronister has served on our board of directors since our IPO in October 2016. Mr. Chronister is currently the owner of Enfield Companies, which is engaged in consulting and investment activities in the oil and gas sector. Mr. Chronister previously served as Interim Chief Executive Officer and Interim President of Bonanza Creek Energy, Inc., a domestic energy exploration and production company, from January 2014 until November 2014 and as a director of Bonanza Creek Energy, Inc., from 2010 to June 2016. From September 2009 until December 2010, Mr. Chronister served as Chairman and interim CEO of Sonde Resources Corp., an oil and gas exploration and production company focused on Western Canada and North Africa, where he also served as a director from 2009 to 2012. Mr. Chronister'sChronister’s prior professional experience includes roles at Deloitte & Touch,Touche, LLP, Kidder Peabody, Merrill Lynch, Transwestern Investments, Kidde Corporation, and N.L. Industries. Mr. Chronister has previously served on the boards of Saratogo Resources, Inc., Harken Energy Corporation and the boards of several private companies and industry associations. Mr. Chronister holds a Bachelor of Business Administration degree from Stephen F. Austin State University. We believe that Mr. Chronister'sChronister’s experience in investing, corporate finance and corporate governance and his service on the board of various energy companies qualify him for service on our board of directors.

John S. Gaensbauer—Independent Director. Mr. Gaensbauer serves as a member of our board of directors, where he has served since our inception. Mr. Gaensbauer is currently a Managing Director in the Natural Resources Group at Capstone Headwaters LLC, a Denver-based investment banking firm (“Capstone Headwaters”). Prior to joining Capstone Headwaters in May 2016, Mr. Gaensbauer was a partner at Sierra Partners LLC, a Denver-based, private advisory group providing strategic advisory services to clients in the global resource industry (“Sierra

Partners”), a role he held since 2007. Prior to Sierra Partners, Mr. Gaensbauer served as Group Executive, Investor Relations for Newmont Mining Corporation (“Newmont”). Prior to that, Mr. Gaensbauer served as in-house counsel to Newmont, managing the legal affairs and transactions for Newmont’s West African, Central Asian and European operations, as well as counsel to Newmont’s Treasury Group and Newmont Capital, Newmont’s in-house merchant banking group. Prior to joining Newmont, Mr. Gaensbauer practiced corporate and transactional law at Ballard Spahr LLP. Mr. Gaensbauer holds a B.A. degree from Cornell University and Masters of Finance and J.D. degrees from the University of Denver. Mr. Gaensbauer has an extensive background in international mining and natural resource transactions and finance which we believe qualify him for service on our board of directors.

Peter A. Leidel—Independent Director. Mr. Leidel has served as a member of our board of directors since our inception. Mr. Leidel is a member of Yorktown Partners LLC (“Yorktown”), a position he has held since he co-founded it in September 1990. Previously, he was a partner of Dillon, Read & Co. Inc.’s venture capital group, an investment bank, held corporate treasury positions at Mobil Corporation, an oil and gas company, and worked for KPMG LLP, an accounting firm, and for the U.S. Patent and Trademark Office. Mr. Leidel is a director of Mid-Con Energy Partners L.P., Thunder Basin Resources, LLC and Carbon Natural Gas Company and is also a director of certain non-public companies in the energy industry in which Yorktown’s funds hold equity interests. He is also a director of the University of Wisconsin Foundation. He is a graduate of the University of Wisconsin, with a BBA degree in accounting and of the Wharton School at the University of Pennsylvania, with an MBA. We believe that Mr. Leidel’s strong accounting background and previous experience serving as director of various public companies engaged in the oil and natural gas industry qualify him for service on our board of directors.

Wayne W. Murdy—Lead Independent Director. Mr. Murdy has served on our board of directors since December 2016. Mr. Murdy previously served as Chief Executive Officer of Newmont Mining Corporation from 2001 to 2007, where he also served as Chairman from 2002 to 2007. Mr. Murdy is also a former Chairman of the International Council on Mining and Metals, a former Director of the U.S. Mining Association and a former member of the Manufacturing Council of the U.S. Department of Commerce. Mr. Murdy has previously served as a director of Weyerhaeuser Company, Qwest Communications International Inc., BHP Billiton Limited and BHP Billiton Plc. Mr. Murdy received his B.S. in Business Administration from California State University at Long Beach. We believe that Mr. Murdy’s extensive experience in the oil and gas industry as well as his financial and corporate finance experience qualify him for service on our board of directors.

Patrick D. O'Brien—O’Brien—Independent Director. Mr. O'Brien has served on our board of directors since our IPO in October 2016. Since September 2011, Mr. O'Brien has served as an advisor to PRL and, since July 2012, Mr. O'Brien has served as a board member of, and advisor to, Elk Meadows Energy Corporation, a private oil and gas exploration and production company. From 2003 until 2010, Mr. O'Brien served as

Table of Contents

CEO of American Oil & Gas, which was acquired by Hess Corporation. Mr. O'Brien co-founded Tower Colombia Corporation in 1995 and served as its CEO and President. He co-founded Tower Energy Corporation in 1984 and Tower Drilling Company in 1980. In 1980, he joined Montana Power Company as Senior Petroleum Engineer with the responsibility for design, long-range planning and performance economics for its exploration and development programs. He joined the Colorado Interstate Gas Company in 1974, where he was responsible for the design, acquisition and development of company-owned gas storage fields. Mr. O'Brien began his career in the oil and gas industry with the Dowell Division of Dow Chemical Company, where he engineered and supervised all phases of well stimulation and cementing. He has over 30 years of experience working the DJ Basin and the Powder River Basin. Mr. O'Brien received his BSB.S. in Petroleum Engineering from the Montana Tech. We believe that Mr. O'Brien's extensive experience in the oil and gas industry generally and in our geographic area of operation specifically qualifies him for service on our board of directors.

Wayne W. Murdy—Director.

Audrey Robertson —Independent Director Mr. Murdy. Ms. Robertson has served on our board of directors since December 2016. Since June 2009, Mr. Murdy has also servedSeptember 2019. She is a co-founder and Chief Financial Officer of Franklin Mountain Energy, LLC, a private oil and gas company operating in the core of the Delaware Basin in southeast New Mexico. Previously, Ms. Robertson was a co-founder and Managing Partner of Copper Trail Partners, LLC, a $50 million energy and private equity platform based in Denver and focused on direct ownership of mineral and working interests in the Rocky Mountain region. She spent 13 years as a director of BHP Billiton LimitedPartner and BHP Billiton Plc, a multinational mining, metalsSenior Managing Director at Kayne Anderson Capital Advisors, and petroleum company. Priorprior to that, Mr. Murdy served as Chief Executive Officer of Newmont Mining Corporation from 2001 to 2007, where he also served as Chairman from 2002 to 2007. Mr. Murdyan investment banker with Goldman Sachs & Co. Ms. Robertson is also a former Chairmanthe co-founder of the International Council on MiningWestside Women in Finance and Metals, a former Directorchairman of the U.S. Mining Associationboard of advisors of ACE Scholarships. She is currently a trustee and a formerboard member of ACE Scholarships. Ms. Robertson remains an active member of the Manufacturing CouncilNational Western Stock Show Association and is also involved with the Private Equity Women’s Investor Network, 85 Broads, YPO’s Rocky Mountain Chapter and the Women in Oil & Gas Association. She holds a degree in Applied Economics from Cornell University and a Master of Accounting from the U.S. DepartmentUniversity of Commerce. Mr. Murdy has previously served as a director of Weyerhaeuser Company and Qwest Communications International Inc. Mr. Murdy received his BS in Business Administration from California State University at Long Beach.Southern California. We believe that Mr. Murdy's extensiveMs.

Robertson’s strong finance background and previous experience in

theleadership roles at oil and gas

industry as well as his financial and corporate finance experiencecompanies qualify

himher for service on our board of directors.

Donald L. Evans—Director. Mr. Evans has served on our board of directors since December 2016. Mr. Evans currently serves as a Senior Partner and Principal at Quintana Capital Group, L.P., where he has served since December 2006, and as a Senior Advisor at Energy Capital Partners, where he has served since July 2006. From February 2010 to March 2014, Mr. Evans served as a director of Genesis Energy LLC. Prior to that, Mr. Evans served as Secretary of Commerce of the United States Department of Commerce from 2001 to 2005 and served as the Chief Executive Officer at the Financial Services Forum from June 2005 to 2007. Mr. Evans currently serves as the Non-Executive Chairman at Energy Future Holdings Corp. where he has served since October 2007, and as a director at Energy Future Intermediate Holding Company LLC. Mr. Evans is currently the Chairman of the George W. Bush Foundation and has previously served as the Chairman of the Board of Regents of the University of Texas System. Mr. Evans received his BS in Mechanical Engineering and M.B.A. from the University of Texas in Austin. We believe that Mr. Evans' extensive experience serving as a director and his extensive financial experience in both the public and private sector qualify him for service on our board of directors.

MEETINGS AND COMMITTEES OF DIRECTORS

The Board of Directors held

three13 meetings

since the Company's initial public offering in

October 2016.2019. During

2016,2019, each of our directors attended at least 75% of the meetings of the Board of Directors and the meetings of the committees of the Board of Directors on which that director served.

Executive Sessions. The Board of Directors holds regular executive sessions in which the independent directors meet without any non-independent directors or other members of management. The purpose of these executive sessions is to promote open and candid discussion among the independent directors. The Lead Independent Director presides at these meetings and provides the Board of Directors'Directors’ guidance and feedback to our management team. The Board of Directors designated Peter A. LeidelWayne Murdy to serve as the Lead Independent Director in March 2017.2018.

Table of Contents

The Board of Directors has

foursix standing committees: the Audit Committee, the Compensation Committee, the Nominating and Governance Committee,

the Executive Committee, the Hedging Committee and the

ExecutiveFinance Committee.

The

Board of Directors and each Committee of the Board of Directors expects to meet a minimum of four times per calendar year in

20172020 and future

years and the Board of Directors expects each Committee of the Board of Directors to meet between two and four times per calendar year in 2020 and future years.

Audit Committee. The members of the Audit Committee are Messrs. Chronister, Leidel, EvansGaensbauer and Murdy and Ms. Robertson, and Mr. Murdy serves as Chairman of the Audit Committee. Mr. Gaensbauer was appointed to the Audit Committee in July 2019 and Ms. Robertson was appointed to the Audit Committee when she joined the Board in September 2019. Donald Evans was a member of the Audit Committee until he departed the Board in July 2019. The Audit Committee held twofive meetings since the Company's initial public offering in October 2016.2019. Additional information regarding the functions performed by the Audit Committee and its membership is set forth in the "Audit“Audit Committee Report"Report” included herein and also in the "Audit“Audit Committee Charter"Charter” that is posted on the Company'sCompany’s website at www.extractionog.com.

Compensation Committee. Responsibilities of the Compensation Committee, which are discussed in detail in the "Compensation“Compensation Committee Charter"Charter” that is posted on the Company'sCompany’s website atwww.extractionog.com, include, among other duties, the responsibility to:

•review, evaluate and approve the agreements, plans, policies and programs of the Company to compensate the Company'sCompany’s executive officers and directors;

•review and discuss with the Company'sCompany’s management the Compensation Discussion and Analysis included in this Proxy Statement;

•once required, produce the Compensation Committee Report as required by Item 407(e)(5) of Regulation S-K included in this Proxy Statement;

•otherwise discharge the Board'sBoard’s responsibilities relating to compensation of the Company'sCompany’s executive officers and directors; and

•perform such other functions as the Board may assign to the Committee from time to time.

The Compensation Committee is delegated all authority of the Board of Directors as may be required or advisable to fulfill its purposes. The Compensation Committee may delegate to its Chairman, any one of its members or any subcommittee it may form the responsibility and authority for any particular matter as it deems appropriate from time to time under the circumstances. Meetings may, at the discretion of the Compensation Committee, include members of the Company'sCompany’s management, other members of the Board of Directors, consultants or advisors and such other persons as the Compensation Committee believes to be necessary or appropriate. The Compensation Committee will consult with the Company'sCompany’s Chief Executive Officer when evaluating the

performance of, and setting the compensation for, the

Company'sCompany’s executive officers other than the Chief Executive Officer.

The Compensation Committee may, in its sole discretion, retain and determine funding for legal counsel, compensation consultants, as well as other experts and advisors (collectively,

"Committee Advisors"“Committee Advisors”), including the authority to retain, approve the fees payable to, amend the engagement with and terminate any Committee Advisor, as it deems necessary or appropriate to fulfill its responsibilities.

The members of the Compensation Committee are Messrs. Chronister,

Gaensbauer, Leidel and

O'BrienO’Brien and Mr. Chronister serves as the Chairman of the Compensation Committee.

Mr. Gaensbauer was appointed to the Compensation Committee in May 2019. The Compensation Committee

did not hold anyheld six meetings

between the Company's initial public offering in

October 2016 through the end of 2016.2019.

Nominating and Governance Committee. The Nominating and Governance Committee advises the Board, makes recommendations regarding appropriate corporate governance practices and assists the Board in implementing those practices. The Nominating and Governance Committee further assists the Board by identifying individuals qualified to become members of the Board, consistent with the criteria

Table of Contents

approved by the Board, and by recommending director nominees to the Board for election at the annual meetings of stockholders or for appointment to fill vacancies on the Board. Additional information regarding the functions performed by the Nominating and Governance Committee is set forth in the "Corporate Governance"“Corporate Governance” and "Stockholder“Stockholder Proposals; Identification of Director Candidates"Candidates” sections included herein and also in the "Nominating“Nominating and Governance Committee Charter"Charter” that is posted on the Company'sCompany’s website at www.extractionog.com. www.extractionog.com

.

The members of the Nominating and Governance Committee are Messrs. Chronister,

Erickson, Leidel,

O'Brien,Murdy and

MurdyO’Brien, and Mr. Leidel serves as Chairman of the Nominating and Governance Committee. The Nominating and Governance Committee

did not hold anyheld three meetings

between the Company's initial public offering in

October 2016 through the end of 2016.2019.

Executive Committee. The executive committeeExecutive Committee is responsible for assisting the Board and the Audit Committee in fulfilling their oversight responsibilities with respect to the annual review of ourthe Company’s oil and natural gas reserves and of any independent qualified reserves consultant.consultant; assisting the Board in the development, implementation and monitoring of the Company’s health, safety and environment policies; and assisting the Board and the management of the Company in their oversight of the Company’s long-term strategy development and implementation. The Executive Committee has adopted a charter that is posted on the Company'sCompany’s website at www.extractionog.com.

The members of the

executive committeeExecutive Committee are Messrs.

Erickson, Leidel,

O'Brien, Evans andO’Brien, Owens and

Tyree, and Mr.

O'BrienO’Brien serves as Chairman of the Executive Committee.

Table of Contents

EXECUTIVE COMPENSATION

Named Mr. Tyree was appointed to the Executive Officers

We are currently considered an emerging growth company for purposesCommittee when he joined the Board in March 2020. Mark Erickson and Donald Evans were members of the SEC's executive compensation disclosure rules. Accordingly, our compensation disclosure obligations are more limitedExecutive Committee until they departed the Board in March 2020 and extend onlyJuly 2019, respectively.

Hedging Committee. The Hedging Committee was established by the Board of Directors in December 2018 to assist the Board in providing oversight to the individuals servingCompany with respect to its commodity hedging activities. The members of the Hedging Committee are Messrs. Chronister and Gaensbauer, and Mr. Leidel serves as our chief executive officerChairman of the Hedging Committee. The Board expects the Hedging Committee to meet periodically as needed.

Finance Committee. The Finance Committee was established by the Board of Directors in December 2019 to assist the Board in providing oversight to the Company with respect to strategic initiatives to simplify and our two other most highly compensated executive officers (our "Named Executive Officers"). Forimprove the Company’s capital structure and with respect to debt reduction efforts. The members of the Finance Committee are Mr. Leidel and Ms. Robertson, and Mr. Gaensbauer serves as Chairman of the Finance Committee. The Board expects the Finance Committee to meet periodically as needed.

PROPOSAL TWO:

RATIFICATION OF APPOINTMENT OF INDEPENDENT AUDITORS

The Audit Committee of the Board of Directors has appointed PwC as the independent registered public accounting firm of the Company for the fiscal year ending December 31, 2020. The audit of the Company’s consolidated financial statements for the fiscal year ended December 31, 2016,2019, was completed by PwC on March 12, 2020.

The Board of Directors is submitting the appointment of PwC for ratification at the Annual Meeting. The submission of this matter for approval by stockholders is not legally required, but the Board of Directors and the Audit Committee believe the submission provides an opportunity for stockholders through their vote to communicate with the Board of Directors and the Audit Committee about an important aspect of corporate governance. If the stockholders do not ratify the appointment of PwC, the Audit Committee will reconsider the appointment of that firm as the Company’s auditors.

However, the Audit Committee has the sole authority and responsibility to retain, evaluate and replace the Company’s auditors. The stockholders’ ratification of the appointment of PwC does not limit the authority of the Audit Committee to change auditors at any time.

Audit and Other Fees

The table below sets forth the aggregate fees billed by PwC, the Company’s independent registered public accounting firm, for the last two fiscal years (in thousands):

| | | | | | | | | | | |

| 2019 | | 2018 |

| Audit Fees(1) | $ | 1,848,275 | | | $ | 1,832,965 | |

| Audit-Related Fees | — | | | 30,000 | |

| Tax Fees | 159,180 | | | 108,569 | |

| All Other Fees | 2,778 | | | 2,766 | |

| Total | $ | 2,010,233 | | | $ | 1,974,300 | |

___________________________

(1) Audit fees consist of the aggregate fees billed for professional services rendered for (a) the audit of our annual financial statements included in our Annual Report on Form 10-K and a review of financial statements included in our Quarterly Reports on Form 10-Q, (b) the filing of our registration statements for equity securities offerings, (c) the audit of the annual stand-alone financial statements of our subsidiary, (d) services that are normally provided in connection with statutory and regulatory filings or engagements for those years and (e) accounting consultations.

The charter of the Audit Committee and its pre-approval policy require that the Audit Committee review and pre-approve the plan and scope of PwC’s audit, audit-related, tax and other services. For the year ended December 31, 2019, the Audit Committee pre-approved 100% of the services described above.

The Company expects that representatives of PwC will be present at the Annual Meeting to respond to appropriate questions and to make a statement if they desire to do so.

Vote Required

Approval of Proposal TWO requires the affirmative vote of the holders of a majority of the shares present, in person or by proxy, and entitled to be voted at the Annual Meeting. Votes cast FOR or AGAINST and abstentions with respect to this Proposal TWO will be counted as shares entitled to vote on the Proposal. For these purposes, brokers have the discretion to vote if they do not receive voting instructions from the beneficial owner. A vote to ABSTAIN will have the effect of a vote AGAINST the Proposal.

Recommendation

The Board of Directors unanimously recommends that stockholders vote FOR the ratification of the appointment of PricewaterhouseCoopers LLP as the auditors of the Company for the fiscal year ending December 31, 2020.

COMPENSATION COMMITTEE REPORT

The information contained in this Compensation Committee Report shall not be deemed to be “soliciting material” or to be “filed” with the SEC, nor shall such information be incorporated by reference into any future filing under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended, except to the extent that the Company specifically incorporates such information by reference in such filing.

The Compensation Committee reviewed and discussed the Compensation Discussion and Analysis required by Item 402 of Regulation S-K promulgated by the SEC with management of the Company, and, based on such review and discussions, the Compensation Committee recommended to the Board of Directors that such Compensation Discussion and Analysis be included in this Proxy Statement and incorporated by reference into the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2019.

Compensation Committee of the Board of Directors

Marvin M. Chronister, Chairman

John S. Gaensbauer, Member

Peter A. Leidel, Member

Patrick D. O’Brien, Member

COMPENSATION DISCUSSION AND ANALYSIS

Named Executive Officers

This Compensation Discussion and Analysis provides information about our rationale and policies regarding the compensation of the executive officers who were our “Named Executive Officers” for 2019, including all individuals who served as our principal executive officer (Mr. Owens and Mr. Erickson), all individuals who served as our principal financial officer (Mr. Kelley and Mr. Brock), and our two most highly compensated executive officers other than our principal executive officers and principal financial officers who were serving at the end of 2019 (Mr. Christ and Ms. Foschi). Our Named Executive Officers

were:for 2019 consist of:

| | | | | | | | |

| Name | | | | Principal Position |

|---|

| Matthew R. Owens | | President, Chief Executive Officer and Director |

| Mark A. Erickson | | Former Chief Executive Officer and Chairman |

Matthew R. Owens | | President and Director |

| Russell T. Kelley, Jr. | | Former Chief Financial Officer |

| Tom L. Brock | | Vice President, Chief Accounting Officer and Principal Financial Officer |

| Eric J. Christ | | Vice President, General Counsel and Corporate Secretary |

| Marianella Foschi | | Vice President of Finance |

Other than the individuals listed above, no other individuals served as executive officers for us in 2019. This Compensation Discussion and Analysis is intended to provide context for the tabular disclosure provided in the executive compensation tables below and to provide investors with the material information necessary to an understanding of our compensation policies and decisions.

Executive Summary

We are an independent oil and natural gas company operating in the DJ Basin, where we develop unconventional oil and natural gas reserves. As we grow reserves, production, and cash flow by developing our liquids-rich resource base, we seek to create long-term value for our stockholders, employees, energy consumers, and the communities in which we work. With these goals in mind, our executive compensation program is designed to attract, retain, motivate, and appropriately reward talented and experienced executives while ensuring that the interests of the Named Executive Officers are aligned with the long-term interests of our stockholders.

2019 Company Performance

Despite the headwinds facing the exploration and production industry during the year, we accomplished a number of significant achievements in 2019, including the following:

•We generated $122 million and $36 million of free cash flow for the second half of 2019 on an upstream and fully consolidated basis, respectively;

•We reduced outstanding borrowings under our revolving credit facility by $80 million during the fourth quarter of 2019;

•We began drilling under our Operating Agreement in the City and County of Broomfield, redefining “industry standard” and establishing a new, higher bar for operating above state and federal regulations;

•We reduced our “all-in” cycle times by 29% as compared to 2018, with our average cycle time on a two-mile well for drilling, clean-out, completion, and flow back to a total of only 10.7 days;

•We diversified our midstream takeaway options, mitigating the basin-wide capacity shortages that significantly curtailed our production during 2018;

•We built on our strong safety record, which has now eclipsed 2 million employee hours without a single, recordable employee incident.

•We reduced our cash general and administrative (“G&A”) expense from $2.39/barrel of oil equivalent (“BOE”) in 2018 to $1.69/BOE in 2019, a 29% decline year-over-year.

•We generated approximately $56 million of cash proceeds through the divestiture of non-strategic assets in a difficult divestiture market.

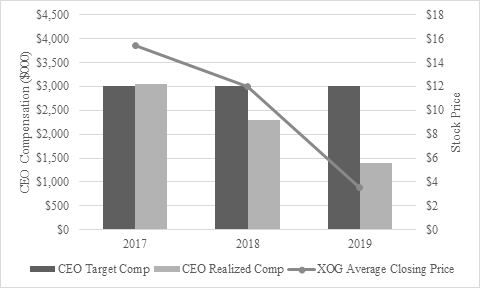

CEO Target Compensation vs. Realized Compensation

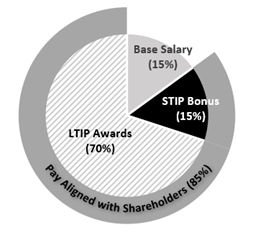

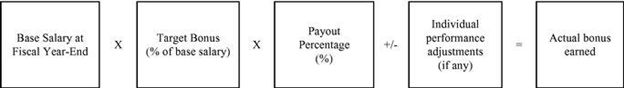

The Compensation Committee believes that the compensation actually received by our Named Executive Officers should be strongly correlated with the Company’s performance and also the overall stockholder experience. The Committee believes that the compensation program in place accomplishes this, with a large portion of overall target compensation dependent on achieving specific pre-determined quantitative goals and the Company’s long-term total stockholder return, both on an absolute basis and on a relative basis as compared to our peers. The chart below depicts, for the last three fiscal years, the amount of compensation targeted to be delivered to our CEO and the amount of compensation actually realized by him in those three years, along with the Company’s average share price during those three years. We have included Mr. Owens’s compensation in the chart below because he became our interim CEO in April 2019 when Mr. Erickson took a medical leave of absence, and the Compensation Committee recognized Mr. Owens’s service in this role when determining his compensation for 2019.

CEO 3-Year Target vs. Realized Compensation

Target Compensation:Target base salary rate, target short-term cash incentive program (“STIP”) bonus, and target grant under our 2016 Amended and Restated Long Term Incentive Plan (“LTIP”)

Realized Compensation: Actual base salary received, actual STIP bonus awarded, and value of equity awards at the time of vesting. For more detail on “Realized Compensation,” see page 28.

Stock Price: Valued using the average closing price for each fiscal year, which was $15.41 for 2017, $11.97 for 2018, and $3.56 for 2019.

The realized compensation depicted here is significantly lower than the compensation indicated in the “Summary Compensation Table” on page 27, largely due to the fact that the Summary Compensation Table utilizes the accounting value of equity awards as of the date of grant, rather than the actual value of those awards upon vesting. Additionally, some equity awards presented in the Summary Compensation Table as compensation, such as performance-based equity awards, may only be partially earned or unearned altogether based on actual performance under the performance metrics of such awards. The chart above is not intended to replace the Summary

Compensation Table. Rather, the Summary Compensation Table and the information above each serves a different purpose and provides a different insight for investors.